Customer Acquisition Cost Calculator: Free Tool to Optimize CAC

Why Your Customer Acquisition Cost Calculator Became Essential

Remember those simpler times when getting new customers felt easy? A modest Facebook ad budget seemed like a license to print money. Those days, unfortunately, are long gone. The marketing landscape has undergone a seismic shift, and if you're still relying on yesterday's playbook, you're probably hemorrhaging cash without even knowing it. Before we dive in, it's important to understand what we're talking about. Customer Acquisition Cost (CAC), simply put, is the total cost of winning a new customer. You can learn more about CAC here.

This isn't just about which platforms are trendy; it's a fundamental change in how we connect with our audience. Think increased competition, market saturation, and the ever-changing privacy rules – they’ve all contributed. The old "spray and pray" marketing approach – blast out a generic message and hope for the best – is now a surefire way to burn through your budget. This is exactly where a reliable customer acquisition cost calculator comes in; it’s like your financial GPS in the chaotic world of modern marketing.

In today's complex market, precision is paramount. You absolutely need to know how much each new customer is costing you. Globally, we’ve seen a dramatic rise in CAC, a clear sign of how much digital advertising has transformed. Just look at the numbers: customer acquisition costs have jumped 60% over the past five years, hitting an average of $29 per new user in 2024. More on these rising costs here. This makes your CAC calculator not just a helpful tool, but a vital tool for survival and growth in this fiercely competitive environment. In the following sections, we’ll break down how to build a robust CAC calculator and, more importantly, how to use the insights you gain to optimize your marketing spend.

The Hidden Costs Your Customer Acquisition Cost Calculator Must Capture

Let's be honest, most companies significantly underestimate their Customer Acquisition Cost (CAC). Everyone focuses on the obvious stuff like ad spend, but a truly accurate CAC calculation needs to go much deeper. You need to account for every single dollar spent, even the sneaky ones that seem to blend into the background. If you don't, your profitability metrics could be way off.

Think about all the moving parts involved in acquiring a new customer. What's happening beyond your Facebook Ads and Google Ads campaigns? There are marketing salaries, your email marketing software subscription, the cost of producing that amazing blog content, promotional discounts you're offering, and even the time your CEO spends on sales calls. These all represent real costs that contribute to your CAC.

For example, imagine launching a new product. You're diligently tracking your ad spend, which is great, but what about the designer who crafted those beautiful landing page graphics? That's a hidden cost that can easily slip through the cracks and distort your CAC calculations. We're often told that the average CAC for e-commerce businesses is around $70 per customer (projected for 2025), covering all marketing and sales expenses. You can learn more about average e-commerce CAC here. But remember, that average is only helpful if your own tracking is thorough and complete.

Overlooking these seemingly small expenses is a bit like a slow leak in a boat. It might not seem like much at first, but over time, those little drips can add up to a big problem and sink your whole operation.

Identifying Hidden CAC Costs

To help you plug those leaks and gain a comprehensive understanding of your CAC, let's take a closer look at some frequently missed expenses. I’ve put together a handy checklist you can use:

A good way to categorize these costs is to consider everything involved in your sales and marketing funnel. This provides a structured approach and ensures you're not missing any key components.

Here's a detailed breakdown:

Complete CAC Components Checklist A comprehensive breakdown of all costs to include in your customer acquisition cost calculator

| Cost Category | Examples | Often Overlooked |

|---|---|---|

| Marketing Salaries | Content writers, SEO specialists, social media managers | In-house team time allocation |

| Software Subscriptions | CRM, email marketing, analytics, project management | Free trials converting to paid |

| Content Creation | Blog posts, infographics, videos, ebooks | Design and editing time |

| Advertising | Paid search, social media ads, display ads | Retargeting campaign costs |

| Website Costs | Hosting, domain registration, design & development | Ongoing maintenance and updates |

| Sales Salaries & Commissions | Sales team salaries, bonuses, commissions | Travel expenses for client meetings |

| Customer Support | Training materials, help desk software | Time spent onboarding new customers |

| Promotional Expenses | Discounts, coupons, free trials, giveaways | Cost of goods for free samples |

| Event Marketing | Conference booths, webinars, networking events | Travel and accommodation for staff |

This checklist provides a great starting point for building a more accurate and insightful customer acquisition cost calculator. Remember, a truly comprehensive CAC calculation captures all the costs associated with acquiring a new customer. By using this checklist, you can get a clearer picture of your actual acquisition costs and make more informed business decisions.

In the next section, we'll explore how to use this information to calculate your CAC and, more importantly, how to optimize it for improved profitability.

Industry Benchmarks That Make Strategic Sense

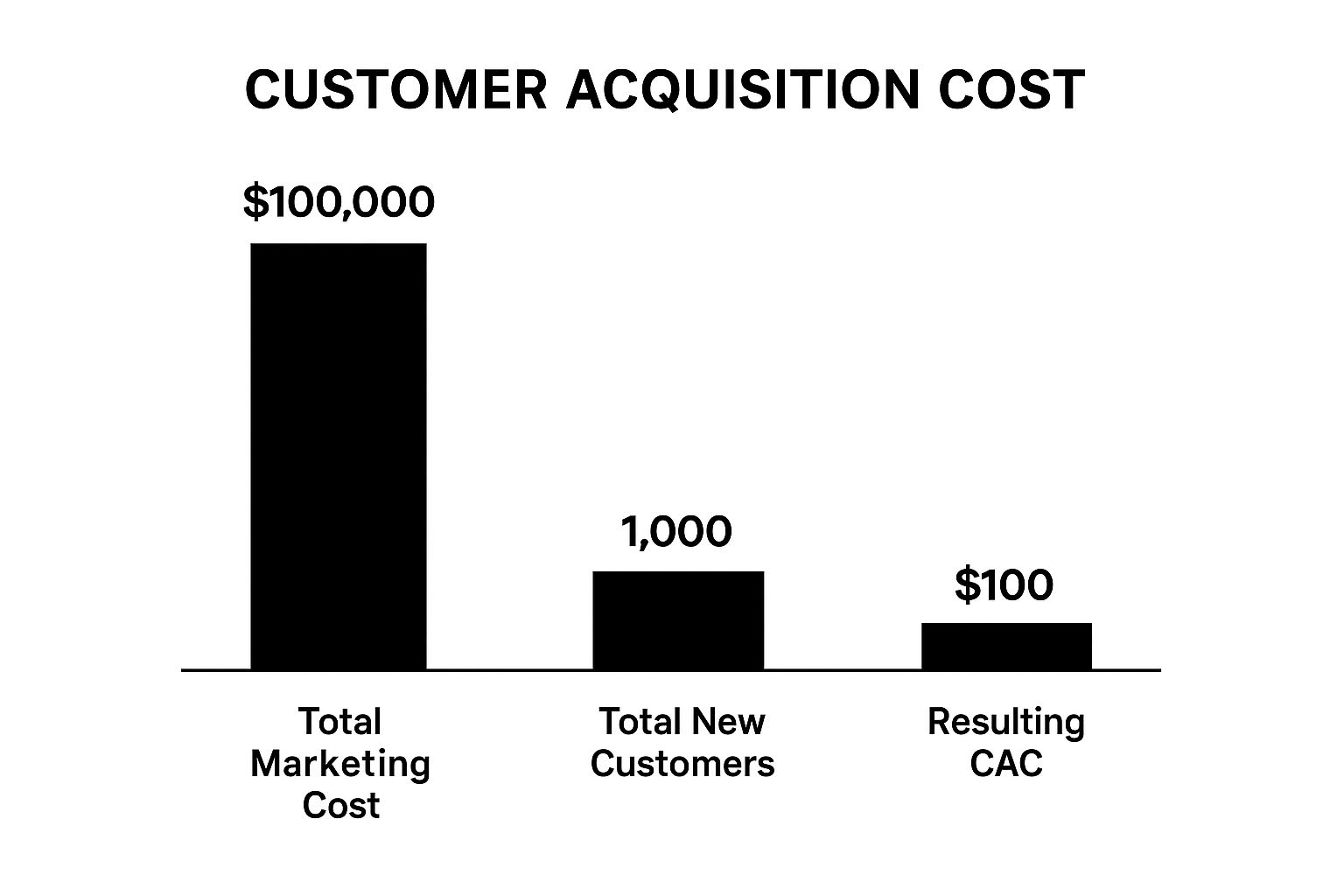

This infographic breaks down Customer Acquisition Cost (CAC) simply: you've got your total marketing spend, the number of new customers you bagged, and the resulting CAC. A $100,000 marketing investment snagging 1,000 new customers means a $100 CAC. Easy peasy, right? But let's get real.

Real-world CAC calculations need context. Benchmarking is key, but not against just any business. Comparing a local bakery's CAC to, say, Apple's is pointless. You need to look at your competitors.

Knowing your industry average gives you a realistic target and helps you figure out if your costs are through the roof or if you're actually killing it.

Understanding Industry Averages

If your customer acquisition strategies involve WhatsApp, remember to include the platform's costs. A handy tool for this is the WhatsApp Pricing Calculator. Industry trends matter. Rising acquisition costs have big implications, especially when you consider benchmarks.

For instance, the health and beauty sector has an average CAC of $127, while fashion and accessories are a tad higher at $129 (based on 2025 projections). Compare that to arts and entertainment, with a much lower average CAC of $21. Big difference, huh?

To delve deeper into industry-specific CAC data, check out this helpful resource from Shopify. These differences aren't random; they're all about customer behavior and market dynamics. By analyzing these benchmarks, you can spot trends and opportunities your competitors might be missing. This can seriously shape your acquisition strategy.

To help you understand these benchmarks better, let’s take a look at the following table:

CAC Benchmarks by Industry Average customer acquisition costs across different industries with context for strategic planning

| Industry | Average CAC | Key Factors | Optimization Opportunities |

|---|---|---|---|

| Health & Beauty | $127 | High competition, brand loyalty, repeat purchases | Influencer marketing, content marketing, loyalty programs |

| Fashion & Accessories | $129 | Trend-driven market, fast-changing inventory, high return rates | Targeted advertising, social media marketing, personalized recommendations |

| Arts & Entertainment | $21 | Lower price points, impulse purchases, event-driven sales | Social media engagement, email marketing, partnerships |

| Software (B2B) | $205 | Longer sales cycles, complex product offerings, higher contract values | Content marketing, targeted advertising, free trials/demos |

This table provides a glimpse into average CAC figures across several industries and demonstrates how significantly they can vary. Understanding these benchmarks within your specific industry offers valuable context for evaluating your own CAC performance.

By analyzing the key factors influencing CAC and exploring optimization opportunities, you can develop a more informed and effective customer acquisition strategy. This allows you to allocate resources wisely and maximize your return on investment.

Building Your Customer Acquisition Cost Calculator From Scratch

Let's dive into creating a Customer Acquisition Cost (CAC) calculator that's actually useful for your business. Forget generic templates—we're building something custom. We'll start with the basic CAC formula and then tailor it to your specific needs.

Setting Up Your CAC Formula

The core formula is pretty straightforward: CAC = (Cost of Sales + Cost of Marketing) / Number of New Customers. But defining those "costs" is where it gets interesting. Think beyond just your ad spend on platforms like Google Ads. Factor in salaries for your sales and marketing teams, your HubSpot subscription, the cost of creating that awesome explainer video—basically, everything that goes into attracting new customers.

Remember that time I was consulting for that fashion startup? Their CAC calculations were way off because they weren't including the cost of influencer marketing campaigns. It made a huge difference once we factored that in.

Tracking for Accuracy

A good CAC calculator relies on good data. You need systems in place to track all relevant expenses. This might involve integrating your Salesforce CRM, your marketing automation platform, and your accounting software. If you're running a SaaS business, for instance, you'll want to closely track trial sign-ups, conversions to paid plans, and the marketing campaigns that drove those conversions.

This Salesforce screenshot shows how different marketing channels can contribute to your overall CAC. See how each channel's cost is broken down? That level of detail is key to understanding which channels provide the best return on investment (ROI).

Handling Attribution and Sales Cycles

Figuring out which marketing touchpoints get credit for a conversion (attribution) can be tricky. Start simple with last-click attribution and then explore multi-touch attribution models as you get more comfortable. Don't forget about your sales cycle length either. Longer sales cycles mean more time and resources to acquire a customer, which directly impacts your CAC.

Practical Examples and Pitfalls

Let's say you run an e-commerce store. You launch a new product line and meticulously track your ad spend. But wait! You forgot to include the cost of the photographer and stylist for your product photos. That's a hidden cost that can skew your CAC. These hidden costs are everywhere. Be thorough!

By accurately tracking costs, handling attribution effectively, and considering your unique sales cycle, you'll build a CAC calculator that provides valuable insights. You can then make smart decisions about where to invest your marketing budget for optimal growth.

Reading What Your Customer Acquisition Cost Calculator Reveals

Your customer acquisition cost (CAC) calculator isn't just about crunching numbers; it's like having a checkup for your business. It’s important to pay attention to the story it’s telling. The real value isn't just the final CAC number, but the trends and patterns it reveals. These insights can help you find ways to improve and avoid potential budget problems before they happen.

For example, let's say your CAC suddenly jumps up. Should you panic? Not necessarily. If it happens alongside a new product launch or a big seasonal marketing campaign, a temporary increase is perfectly normal. But if the rise is steady and you can't explain it, that could be a sign of trouble. Maybe your ad targeting needs adjusting, or a competitor's campaign is driving up your costs.

Deciphering the Signals

Here are a few things to keep an eye on:

- Fluctuations: Short-term CAC changes often reflect specific marketing activities you're running. Analyze these changes alongside your campaign performance data to understand the real impact.

- Seasonal Variations: Many businesses see predictable CAC changes throughout the year. Think holiday shopping, back-to-school sales, etc. Understanding these patterns is key for budgeting and planning.

- Channel Performance: A good CAC calculator breaks down the cost by channel. This helps you see which channels give you the best return and which are wasting your money. I once worked with a client whose social media CAC was three times higher than their search engine CAC. That discovery led to a big shift in their strategy.

This means successful business owners don't just calculate their CAC; they dig into it. They look for the why behind the numbers. Are you spending too much on getting new customers and not enough on keeping the ones you have? Is your marketing message reaching the right people? Your CAC calculator can help answer these questions.

Spotting the Red Flags

Sometimes, the most telling sign is what your calculator isn't showing you. A consistently low CAC might seem amazing, but it could mean you’re missing some costs. Remember those hidden expenses we talked about? If your calculator isn’t accounting for everything, your data is inaccurate, and your strategy could be built on shaky ground. This can lead to overspending and, ironically, a much higher CAC than you think. So, regularly check what you're putting into your calculator and make sure you’re including all the relevant data. This careful attention can be the difference between healthy profits and a nasty financial surprise.

Optimization Strategies That Generate Real CAC Reductions

So, you've figured out your Customer Acquisition Cost (CAC) and have a decent understanding of what others in your industry are seeing. Now for the real challenge: refining your approach to lower those costs and boost your profits. A lower CAC isn't just about saving money; it's about having more resources to reinvest in growth and create a more stable business.

Retention Is Your Secret Weapon

One of the best ways to lower your CAC might surprise you: focus on keeping your current customers. It sounds counterintuitive, but think about it – if your customers stay longer, you don't have to spend as much attracting new ones to maintain your income. A strong retention strategy takes the pressure off acquisition, letting you be more deliberate and less reactive.

I saw this firsthand with a subscription box company obsessed with new subscribers. Their CAC was through the roof! By creating a simple loyalty program and improving their onboarding process, we significantly reduced churn. The result? Their overall CAC dropped dramatically. It was a complete game-changer.

Channel Rebalancing: Find Your Sweet Spot

Not all acquisition channels are equal. Some, like paid advertising, can get really pricey, especially in competitive markets. Regularly check your data from your customer acquisition cost calculator to see which channels are providing the best ROI. You might find that shifting your focus – maybe leaning more into organic search (SEO) or content marketing – can dramatically lower your CAC.

Optimizing Customer Lifetime Value (CLTV)

CLTV and CAC are two sides of the same coin. Lowering CAC is essential, but raising your CLTV is just as effective. By focusing on getting repeat purchases, upsells, and cross-sells, you're essentially spreading the acquisition cost over a longer period, making each customer more valuable. Think personalized recommendations, loyalty programs, or even just providing outstanding customer service.

Data-Driven Decisions: Your Calculator Is Your Compass

Your customer acquisition cost calculator isn't just for crunching numbers; it's a powerful tool for strategic decisions. Use it to experiment with different tactics, monitor your progress, and identify where you can improve. This data-driven approach means you’re making informed choices based on real information, not just guessing, and those informed choices lead directly to real CAC reductions.

Ready to launch your next AI-powered project without the setup hassles and coding complexities? AnotherWrapper, a complete AI starter kit, helps developers and founders launch micro SaaS projects in mere hours. From AI image generation to advanced chatbots, explore 10 fully customizable demo applications and skip the repetitive setup work. Check out AnotherWrapper today and get building!

Enjoyed this article?

Get more like this in your inbox

Weekly insights on AI, startups, and shipping faster. No spam.

Written by

Fekri

Building tools for the next generation of AI-powered startups. Sharing what I learn along the way.

Continue reading

You might also enjoy

How to Measure Product Market Fit: Proven Strategies

Learn how to measure product market fit effectively with our expert guide. Discover proven strategies to boost your product’s success. Read more!

Agile Release Management: Your Complete Guide to Success

Master agile release management with proven strategies that work. Learn from successful teams who've transformed their software delivery process.

AI Model Deployment: Expert Strategies to Deploy Successfully

Learn essential AI model deployment techniques from industry experts. Discover proven methods to deploy your AI models efficiently and confidently.